Financial Fraud Detection and Prevention Market Regional Adoption Analysis

The global financial landscape is undergoing a rapid digital transformation, bringing with it a parallel surge in sophisticated cybercrime. As of 2026, financial institutions are no longer just fighting individual hackers but organized criminal syndicates using advanced automation and AI-driven social engineering.

The financial detection and prevention comprises specialized software solutions and services designed to identify, monitor, and block fraudulent activities such as money laundering, identity theft, and payment fraud. In 2025, the market is hitting a critical inflection point. Driven by the "Instant Payment" revolution, the window for detecting fraud has shrunk from days to milliseconds. This has necessitated a shift from reactive, rule-based systems to proactive, AI-driven behavioral biometrics, a key technology used to analyze user patterns to stop account takeovers before they happen.

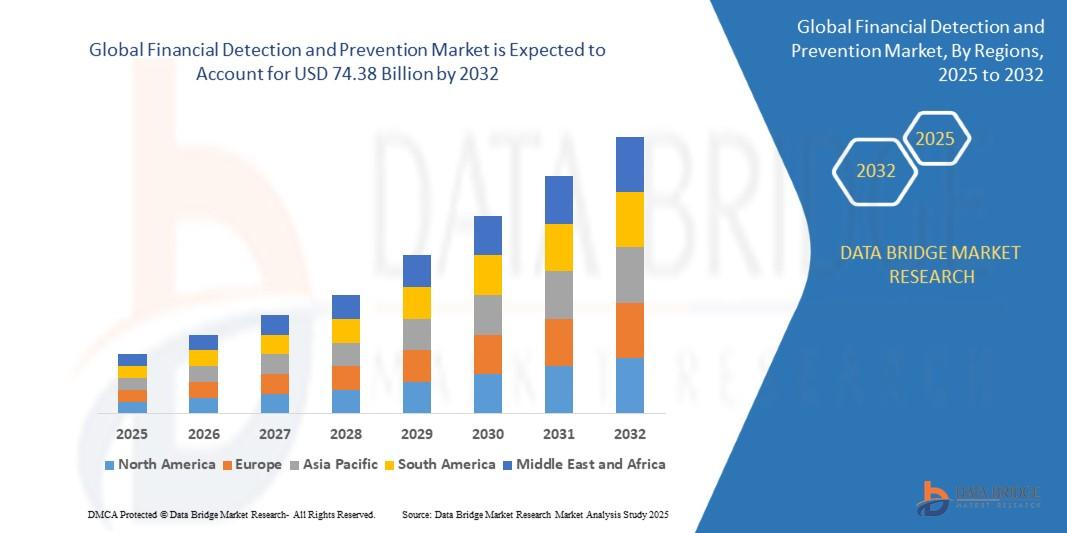

Market Size and Data Forecast (2025–2032)

Based on industry valuations and growth trajectories, the market is positioned for aggressive expansion:

2024 Market Value: USD 29.20 Billion

2025 Forecast Value: Approximately USD 32.82 Billion

2032 Projected Value: USD 74.38 Billion

Compound Annual Growth Rate (CAGR): 12.40% (2025–2032)

The 2025 forecast indicates a robust year-over-year growth as financial institutions prioritize "FRAML"—the convergence of Fraud and Anti-Money Laundering—to close security gaps created by siloed data.

Get a Sample Report of Financial Detection and Prevention Forecast @https://www.databridgemarketresearch.com/request-a-sample?dbmr=global-financial-detection-and-prevention-market

Market Segmentation

The market is diversely segmented to address the multifaceted nature of financial crime:

|

Segment Category |

Key Sub-segments |

|

By Component |

Solutions (Fraud Analytics, Authentication, GRC), Services (Professional, Managed) |

|

By Fraud Type |

Payment Fraud, Identity Fraud, Insider Fraud, Money Laundering, Check Fraud |

|

By Deployment |

Cloud-based (Fastest Growing), On-premise |

|

By Organization |

Large Enterprises (Largest Share), SMEs (High Growth) |

|

By Vertical |

BFSI (Banking, Financial Services, and Insurance), Retail, Government, Healthcare |

Market Share and Regional Insights

North America: Continues to hold the largest market share in 2025, driven by early adoption of AI and stringent regulations like the CCPA and PCI-DSS.

Asia-Pacific: Anticipated to be the fastest-growing region through 2032. The explosion of mobile e-wallets in India and Southeast Asia has created a massive demand for real-time detection tools.

Europe: Maintains a significant share due to the rigorous enforcement of GDPR and new frameworks for open banking security.

Do you have any specific queries or need any Financial Detection and Prevention Submit your inquiry here @https://www.databridgemarketresearch.com/inquire-before-buying?dbmr=global-financial-detection-and-prevention-market

Key Players in Financial Detection and Prevention

The competitive landscape is dominated by a mix of legacy financial service providers, cloud giants, and specialized cybersecurity firms:

Financial & Payment Leaders: Fiserv, Inc. (U.S.), FIS Global (U.S.), ACI Worldwide (U.S.), and Bottomline Technologies, Inc. (U.S.).

Data & Risk Analytics: LexisNexis Risk Solutions (U.S.), TransUnion LLC (U.S.), Experian Information Solutions, Inc. (Ireland), SAS Institute Inc. (U.S.), and FICO (U.S.).

Specialized Security: NICE Actimize (U.S.), RSA Security LLC (U.S.), Securonix (U.S.), Accertify, Inc. (U.S.), Feedzai (Portugal), and ClearSale (Brazil).

Enterprise Tech & Cloud: SAP (Germany), Software GmbH (Germany), Microsoft (U.S.), F5, Inc. (U.S.), and Amazon Web Services, Inc. (U.S.).

Business Process & Audit: Genpact (U.S.) and Caseware International Inc. (U.S.).

Get A Buy Now Report Financial Detection and Prevention Forecast @https://www.databridgemarketresearch.com/checkout/buy/global-financial-detection-and-prevention-market/compare-licence

Future Outlook

The Financial Detection and Prevention market is entering a high-stakes era. By the end of 2025, the focus will shift entirely toward real-time risk scoring and the integration of machine learning to combat "synthetic identities" and deepfake-based fraud.

While the projected growth to USD 74.38 billion by 2032 reflects a massive commercial opportunity, the true success of the market will depend on the ability of key players to balance rigorous security with a frictionless user experience. Organizations that fail to integrate AI-driven, cross-channel protection will likely face not only financial loss but a devastating erosion of consumer trust in an increasingly digital economy.

About Us:

Data Bridge is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact :

Data Bridge Market Research Private Ltd .

3665 Kingsway - Suite 300 Vancouver BC V5R 5W2 Canada

+1 614 591 3140 (US)

+44 845 154 9652 (UK)

Email: Sales@databridgemarketresearch.com

Website: https://www.databridgemarketresearch.com