Voice Banking Market Research Report: Growth, Share, Value, Trends, and Insights

"Latest Insights on Executive Summary Voice Banking Market Share and Size

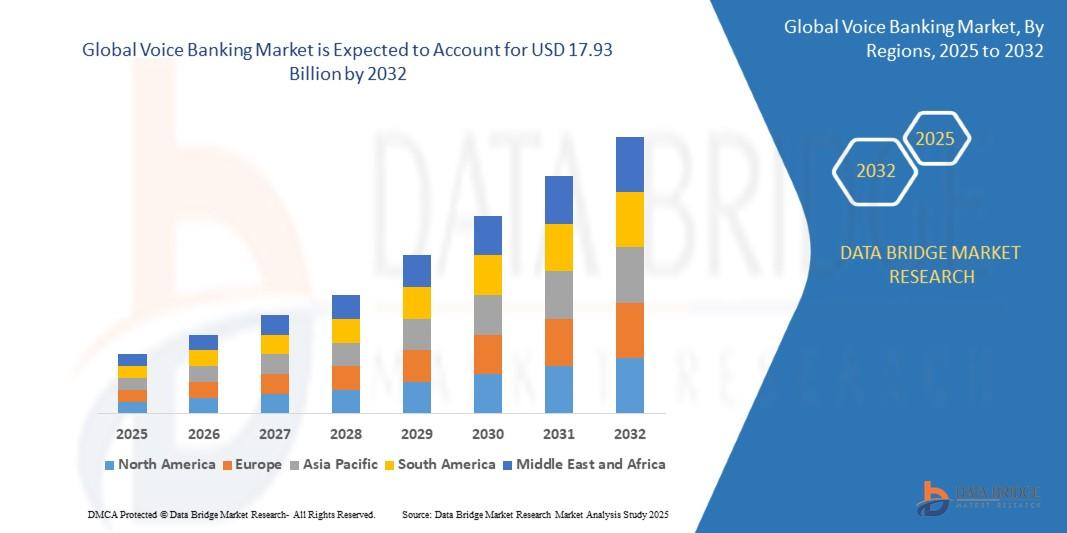

The global voice banking market size was valued at USD 6.20 billion in 2024 and is projected to reach USD 17.93 billion by 2032, with a CAGR of 14.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

The Voice Banking Market report is the best to know the trends and opportunities in Voice Banking Market The forecast, analysis, evaluations, and estimations carried out in this Voice Banking report are all based upon the well-established tools and techniques such as SWOT analysis and Porter’s Five Forces analysis. These are the authentic tools used in market analysis on which businesses can trust confidently. This Voice Banking Market report brings into focus a plentiful number of factors, such as the general market conditions, trends, inclinations, key players, opportunities, and geographical analysis, which all aid in taking your business towards growth and success.

This Voice Banking Market report also estimates the growth rate and the market value based on market dynamics and growth inducing factors. It is a well-versed fact that competitive analysis is the major aspect of any market research report and hence many points are covered under this, including strategic profiling of key players in the market, analyse core competencies of key players, and drawing a competitive landscape for the market. This global Voice Banking business report has been built with the careful efforts of an innovative, enthusiastic, knowledgeable, and experienced team of analysts, researchers, industry experts, and forecasters.

Dive into the future of the Voice Banking Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/global-voice-banking-market

Voice Banking Business Outlook

Segments

- By Component: Solutions, Services

- By Deployment Mode: Cloud, On-Premises

- By Application: Voice Authentication, Fraud Detection and Prevention, Sentiment Analysis

The global voice banking market is segmented based on components, deployment mode, and application. In terms of components, the market is divided into solutions and services. Solutions segment is further classified into interactive voice response (IVR), voice recognition systems, and voice biometrics. On the other hand, services segment includes professional services and managed services. The deployment mode segment is categorized into cloud and on-premises solutions. Cloud-based voice banking services are gaining popularity due to their scalability, cost-effectiveness, and ease of implementation. In terms of application, voice banking is utilized for voice authentication, fraud detection and prevention, and sentiment analysis to enhance customer experience and security in banking operations.

Market Players

- Nuance Communications, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- International Business Machines Corporation (IBM)

- Verint Systems Inc.

- Voci Technologies

- VoiceVault Voice Authentication

- SESTEK

- Foehn

- Sopra Steria

The global voice banking market is highly competitive with the presence of several key players. Companies such as Nuance Communications, Inc., Microsoft Corporation, Amazon Web Services, Inc., and Google LLC are at the forefront due to their advanced technology solutions and continuous innovation in voice banking services. Other notable players in the market include International Business Machines Corporation (IBM), Verint Systems Inc., Voci Technologies, VoiceVault Voice Authentication, SESTEK, Foehn, and Sopra Steria. These market players are focusing on strategic partnerships, product launches, and acquisitions to expand their market presence and cater to the growing demand for voice banking solutions.

The global voice banking market is witnessing significant growth as financial institutions and banks increasingly adopt voice recognition technology to enhance customer experience and improve security protocols. Voice banking solutions offer customers a convenient and secure way to access their accounts, make transactions, and authenticate their identities using their voice. This trend is being driven by the growing preference for self-service options, the increasing adoption of digital banking, and the need for heightened security measures in the face of rising cyber threats in the financial sector.

One of the key trends shaping the voice banking market is the integration of artificial intelligence (AI) and machine learning algorithms to improve the accuracy and effectiveness of voice recognition systems. Advanced AI technologies are enabling voice banking solutions to understand natural language commands, detect anomalies in voice patterns for fraud prevention, and provide personalized responses to customer queries. The integration of AI is also enhancing sentiment analysis capabilities, allowing banks to gain valuable insights into customer emotions and preferences to tailor their services accordingly.

Another important factor influencing the voice banking market is the shift towards cloud-based deployment models. Cloud solutions offer scalability, flexibility, and cost-efficiency, making them an attractive choice for banks looking to deploy voice banking services quickly and efficiently. Cloud-based voice banking solutions also enable seamless integration with existing banking systems and customer databases, leading to improved operational efficiency and faster time-to-market for new services and features.

Moreover, the increasing focus on regulatory compliance and data security is driving banks to invest in robust voice authentication and fraud detection systems. Voice biometrics and multi-factor authentication mechanisms are being implemented to ensure secure access to accounts and protect sensitive customer information from unauthorized access. Regulatory bodies are also advocating for stronger authentication measures to prevent identity theft and financial fraud, further fueling the demand for advanced voice banking solutions.

In conclusion, the global voice banking market is poised for continued growth as financial institutions prioritize customer experience, security, and innovation in their digital transformation efforts. The integration of AI, cloud computing, and advanced authentication technologies will play a key role in shaping the future of voice banking, offering customers a seamless and secure way to interact with their banks using the power of their voice. Market players will need to stay abreast of technological advancements and regulatory developments to capitalize on the opportunities presented by this rapidly evolving market landscape.The global voice banking market is experiencing robust growth driven by the increasing adoption of voice recognition technology by financial institutions and banks to enhance customer experience and strengthen security measures. The demand for voice banking solutions is escalating as customers seek convenient and secure ways to access their accounts, conduct transactions, and verify their identities through voice authentication. This trend is being fueled by the rising preference for self-service options, the surge in digital banking adoption, and the imperative need for heightened security measures amid escalating cyber threats targeting the financial sector. Financial institutions are increasingly recognizing the benefits of voice banking in improving operational efficiency, enhancing customer engagement, and ensuring regulatory compliance in an evolving digital landscape.

The integration of advanced artificial intelligence (AI) and machine learning algorithms is a key trend shaping the voice banking market. AI technologies are transforming voice recognition systems by enabling natural language processing, anomaly detection for fraud prevention, and personalized customer interactions. By leveraging AI capabilities, banks can enhance sentiment analysis to gain valuable insights into customer behaviors and preferences, enabling them to deliver tailored services and personalized experiences. The seamless integration of AI-powered voice banking solutions is streamlining banking operations, optimizing service delivery, and driving efficiency across customer touchpoints.

Cloud-based deployment models are gaining traction in the voice banking market due to their scalability, flexibility, and cost-effectiveness. Cloud solutions offer banks the agility to rapidly deploy voice banking services, integrate with existing systems, and scale operations to meet evolving customer demands. Cloud-based voice banking solutions enable financial institutions to enhance operational agility, improve customer experience, and accelerate time-to-market for innovative services and features. The shift towards cloud deployment models is expected to reshape the voice banking landscape, driving increased adoption among banks seeking to leverage the benefits of cloud technology in delivering secure and reliable voice banking services.

Moreover, the focus on regulatory compliance and data security is fueling investments in robust voice authentication and fraud detection systems by financial institutions. Voice biometrics and multi-factor authentication mechanisms are being deployed to enhance account security, prevent identity theft, and safeguard sensitive customer information. Regulatory authorities are advocating for stronger authentication measures, prompting banks to invest in advanced voice banking solutions to mitigate security risks and ensure compliance with industry regulations. The emphasis on data security and fraud prevention is propelling the demand for cutting-edge voice banking technologies that offer secure, reliable, and seamless interactions between customers and their financial institutions.

In conclusion, the global voice banking market is poised for continued growth as financial institutions embrace digital transformation, prioritize customer-centric innovations, and enhance security measures in an increasingly digital banking landscape. The convergence of AI, cloud computing, and advanced authentication technologies will drive the evolution of voice banking, empowering banks to deliver secure, personalized, and efficient services to their customers. Market players should focus on innovation, strategic partnerships, and regulatory compliance to capitalize on the opportunities presented by the dynamic voice banking market and address the evolving needs of modern banking consumers.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/global-voice-banking-market/companies

Voice Banking Market – Analyst-Ready Question Batches

- What is the current demand volume of the Voice Banking Market?

- How is the market for Voice Banking expected to evolve in the next decade?

- What segmentation criteria are applied in the Voice Banking Market study?

- Which players have the highest market share in the Voice Banking Market?

- What regions are assessed in the country-level analysisfor Voice Banking Market?

- Who are the top-performing companies in the Voice Banking Market?

Browse More Reports:

Global Sausage Casing Market

Global Sinusitis Treatment Drugs Market

Global Smoked Fish Market

Global Touch Sensor Market

Global Vermouth Market

Global Vertebroplasty and Kyphoplasty Market

Global Vibration Energy Harvesting Market

Global Walking Aids Market

Global Flock Adhesives Market

Global Gluten-Free Chocolate Market

Global Aluminium Aerosol Cans Market

Global Connected Health Personal Medical Devices Market

Global HbA1c Testing Market

Global Maternal Blood Test Market

Global OB-GYN Ultrasound Systems Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"