Copper Market Size, Share, Trends, Key Drivers, Demand and Opportunity Analysis

Copper Market: In-Depth Analysis, Trends, and Growth Outlook

1. Introduction

The copper market plays a critical role in the global economy, serving as a foundational material across multiple industries including construction, energy, transportation, electronics, and manufacturing. Known for its excellent electrical conductivity, corrosion resistance, and recyclability, copper has become indispensable in modern infrastructure and emerging technologies.

In recent years, the relevance of copper has increased significantly due to accelerating urbanization, rapid industrial growth, and the global transition toward renewable energy and electric mobility. Copper is a key input in electric vehicles (EVs), solar and wind energy systems, power grids, and data centers, making it central to the decarbonization agenda of many economies.

The global copper market is expected to witness steady growth over the coming years, driven by rising demand from clean energy projects, expanding construction activities, and increased investments in power transmission infrastructure. Market forecasts indicate a compound annual growth rate (CAGR) of approximately 4.5% to 5.5% between 2024 and 2032, reflecting strong long-term fundamentals despite short-term price volatility.

Get strategic knowledge, trends, and forecasts with our Copper Market. Full report available for download:

https://www.databridgemarketresearch.com/reports/global-copper-market

2. Market Overview

Market Scope and Size

The copper market encompasses the production, refining, trading, and consumption of copper in various forms, including cathodes, rods, wires, sheets, and alloys. The market includes both primary copper (mined and refined) and secondary copper (recycled).

As of recent estimates, the global copper market is valued in the range of USD 180–220 billion, with annual production exceeding 25 million metric tons. This market size is expected to expand steadily as demand from energy transition technologies continues to rise.

Historical Trends and Current Positioning

Historically, copper demand has closely followed global economic growth cycles. Periods of industrial expansion and infrastructure development have consistently driven higher consumption, while economic slowdowns have temporarily softened demand.

Over the past decade, the market has shifted from traditional construction-driven demand toward technology-led consumption. Currently, the copper market is positioned at the intersection of industrial growth and sustainability, benefiting from government-led electrification initiatives and private-sector investments in renewable energy and electric transportation.

Demand-Supply Dynamics

The copper market faces a structurally tight supply-demand balance. While demand continues to rise steadily, supply growth is constrained by declining ore grades, longer mine development timelines, and limited new discoveries. Recycling has become an increasingly important supply source, but it is not sufficient to fully offset primary supply limitations.

3. Key Market Drivers

Growth in Renewable Energy and Electrification

Copper is a critical material in renewable energy systems such as solar panels, wind turbines, and energy storage solutions. Electrification of transportation and power grids significantly increases copper intensity, driving sustained demand growth.

Expansion of Electric Vehicle Adoption

Electric vehicles use substantially more copper than conventional vehicles, particularly in batteries, motors, wiring harnesses, and charging infrastructure. Rising EV adoption across developed and emerging economies is a major driver of copper demand.

Urbanization and Infrastructure Development

Rapid urbanization in developing regions is fueling investments in housing, transportation networks, and utilities. Copper remains a preferred material for plumbing, electrical wiring, and industrial machinery.

Technological Advancements

Advancements in electronics, telecommunications, and data centers continue to increase copper usage. The rollout of 5G networks and cloud infrastructure further supports demand.

Government Policies and Investments

Governments worldwide are investing heavily in power grid modernization, renewable energy projects, and sustainable infrastructure, indirectly boosting copper consumption through favorable policies and funding programs.

4. Market Challenges

Supply Constraints and Resource Depletion

Many copper mines are experiencing declining ore grades, which increases production costs and limits output growth. Developing new mines requires significant capital investment and long approval timelines.

Price Volatility

Copper prices are highly sensitive to global economic conditions, currency fluctuations, and geopolitical events. Price volatility can impact profitability for producers and purchasing decisions for end users.

Regulatory and Environmental Challenges

Stricter environmental regulations related to mining operations, water usage, and carbon emissions pose operational challenges. Compliance costs are rising, particularly in regions with strong environmental governance.

Competition from Alternative Materials

In some applications, aluminum and other conductive materials are being used as substitutes for copper due to cost considerations, potentially limiting demand growth in specific segments.

5. Market Segmentation

By Type / Category

Primary Copper: Derived from mining and refining activities; dominates total supply.

Secondary (Recycled) Copper: Gaining importance due to sustainability initiatives and cost advantages.

Fastest-growing segment: Recycled copper, driven by circular economy policies and environmental awareness.

By Application / Use Case

Construction and Infrastructure

Electrical and Electronics

Transportation (Automotive and EVs)

Industrial Machinery

Renewable Energy Systems

Fastest-growing segment: Electric vehicles and renewable energy applications due to higher copper intensity per unit.

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

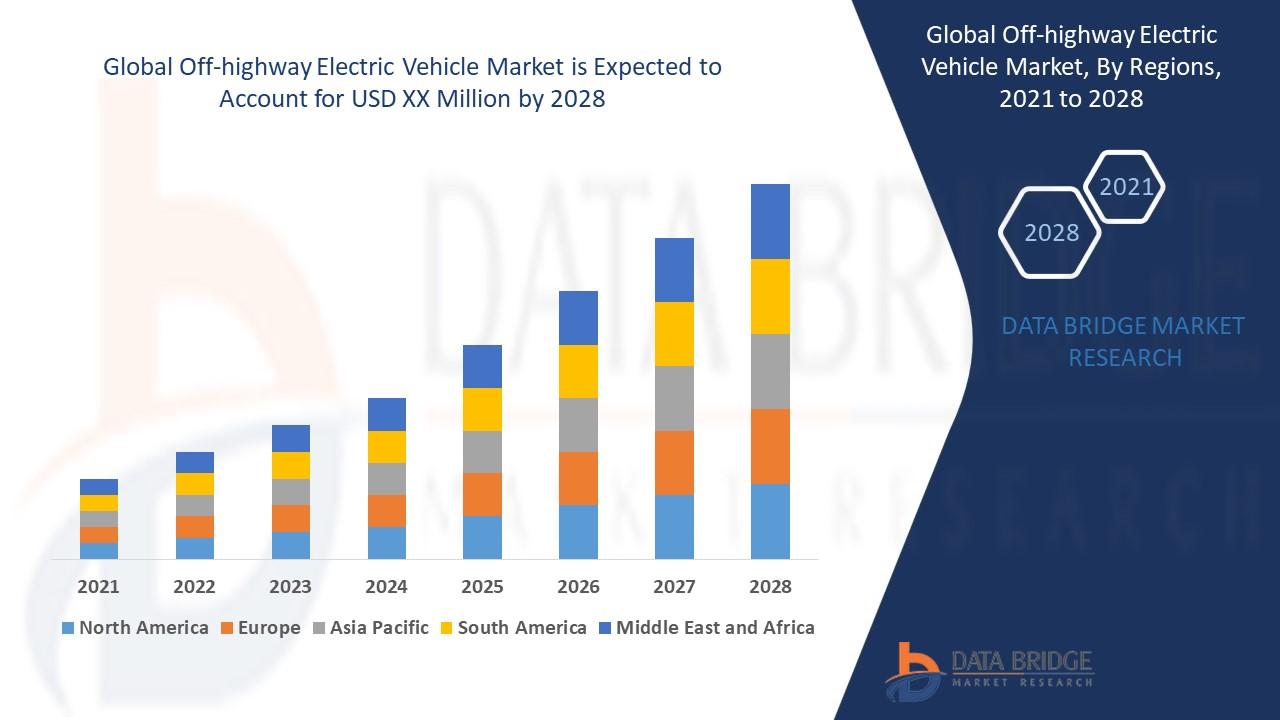

Fastest-growing region: Asia-Pacific, led by industrial expansion, urbanization, and clean energy investments.

6. Regional Analysis

North America

North America remains a mature yet stable copper market. Demand is driven by grid modernization, EV adoption, and construction activity. The region also focuses heavily on recycling and sustainable mining practices.

Europe

Europe’s copper market is shaped by strong environmental regulations and aggressive decarbonization targets. Renewable energy expansion and electric mobility are key demand drivers, while recycling plays a major role in supply.

Asia-Pacific

Asia-Pacific dominates global copper consumption, accounting for the largest market share. China, India, and Southeast Asian countries are major contributors due to manufacturing growth, infrastructure development, and rising energy demand.

Latin America

Latin America is a leading copper-producing region, hosting some of the world’s largest mines. While domestic consumption is moderate, the region plays a critical role in global supply chains.

Middle East & Africa

This region represents an emerging market with growing infrastructure and renewable energy investments. Copper demand is expected to increase gradually as industrialization progresses.

7. Competitive Landscape

The copper market is moderately consolidated, with a mix of large multinational mining companies and regional producers. Key players focus on expanding production capacity, improving operational efficiency, and enhancing sustainability performance.

Common Competitive Strategies

Innovation: Adoption of advanced mining technologies to improve recovery rates and reduce environmental impact.

Pricing Strategies: Long-term supply contracts and hedging to manage price volatility.

Partnerships: Collaboration with governments and technology providers.

Mergers & Acquisitions: Acquiring high-quality assets to secure future supply and expand geographic presence.

Competitive advantage increasingly depends on cost efficiency, sustainability credentials, and access to high-grade reserves.

8. Future Trends & Opportunities

Market Forecast and CAGR

The global copper market is projected to grow at a CAGR of approximately 4.5% to 5.5% from 2024 to 2032. Demand from energy transition technologies is expected to outpace traditional uses, reshaping consumption patterns.

Emerging Trends

Increased use of copper in green technologies

Expansion of copper recycling infrastructure

Digitalization of mining operations

Growing emphasis on responsible sourcing

Opportunities for Stakeholders

Businesses: Investment in recycling, value-added copper products, and low-carbon production technologies.

Investors: Long-term exposure to copper as a strategic metal supporting electrification and sustainability.

Policymakers: Developing balanced regulations that support sustainable mining while ensuring supply security.

9. Conclusion

The copper market is entering a transformative phase, driven by electrification, renewable energy expansion, and global infrastructure development. While supply-side challenges and regulatory pressures persist, strong long-term demand fundamentals support positive growth prospects.

With a forecast CAGR of up to 5.5%, copper remains a strategically important commodity for the global economy. Businesses and investors that prioritize sustainability, innovation, and supply chain resilience are well-positioned to benefit from the market’s long-term potential.

As the world moves toward a low-carbon future, copper will continue to play a vital role in enabling economic growth and technological progress.

Frequently Asked Questions (FAQ)

- Why is copper important to the global economy?

Copper is essential for electricity transmission, construction, transportation, and renewable energy systems, making it a cornerstone of modern industrial economies. - What is driving copper demand growth?

Key drivers include electric vehicle adoption, renewable energy expansion, urbanization, and infrastructure development. - What is the expected CAGR of the copper market?

The copper market is expected to grow at a CAGR of approximately 4.5% to 5.5%over the next decade. - Which region dominates copper consumption?

Asia-Pacific is the largest and fastest-growing copper-consuming region globally. - What are the main challenges facing the copper market?

Major challenges include supply constraints, price volatility, environmental regulations, and competition from alternative materials.

Browse More Reports:

Global Oxidized Bitumen Market

Global Patient Flow Management Solution Market

Global Plastic Drums Market

Global Pressure Transmitter Market

Global Resistive Random-Access Memory (ReRAM) Market

Global Tableau Services Market

Global Tumor Lysis Syndrome Market

Global WI-FI Chipset Market

Global Breast Reconstruction Market

Global Power Bank Market

Global 5G in Automotive and Smart Transportation Market

Global Account Based Marketing Market

Global Acid Proof Lining Market

Global ALAD Porphyria Treatment Market

Global Ammonia Refrigerant Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"